Taxing Remittances—A New Assault in the War on Immigrants

AACYF/旧金山/洛杉矶,2025年6月6日 — Tucked into the thousand plus pages of President Trump’s “big, beautiful” spending package — which passed the House last month — is a proposal to impose a 3.5% tax on remittances. In 2024, US residents sent more than $220 billion to families and friends in other countries: more than half went to Latin America. Mexico is the largest recipient of US remittances, while India is the top recipient of remittances from around the world.

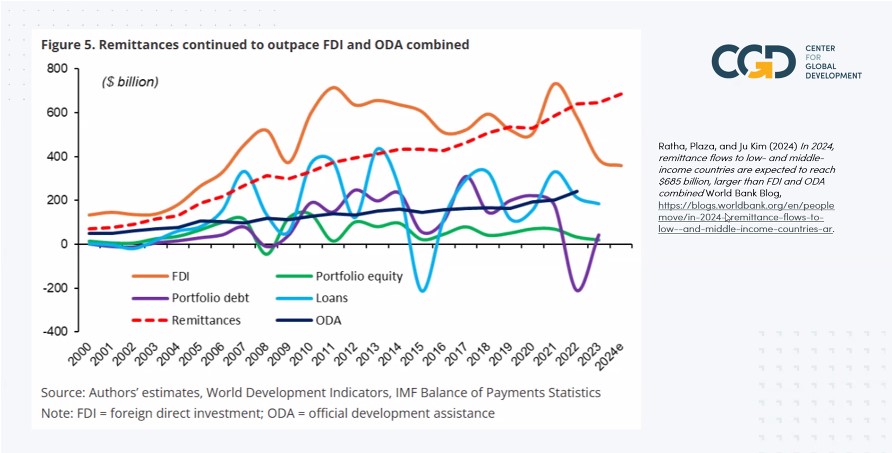

美国社区媒体服务组织(ACoM,原名少数族裔媒体服务EMS)于本周五(6月6日)召开线上研讨会,主题为“Taxing Remittances—A New Assault in the War on Immigrants”。Experts warn the tax would harm economies abroad, especially in lower income countries where remittances account for up to 30% of GDP. Immigrant advocates argue the proposal represents a form of double taxation as senders — including millions of undocumented immigrants — already pay income tax on their earnings. It could, they add, drive many to seek more informal, risker ways to send money home. Economists note that the tax could also adversely impact the US economy.

- Ariel Ruiz Soto, Senior Policy Analyst, Migration Policy Institute

- Helen Dempster, Policy Fellow and Assistant Director for the Migration, Displacement, and Humanitarian Policy Program at the Center for Global Development

- Dr. Manuel Orozco, Director of the Migration, Remittances, and Development Program at the Inter-American Dialogue, and Senior Fellow at Harvard University’s Center for International Development

Ana Valdez, President and CEO of the Latino Donor Collaborative